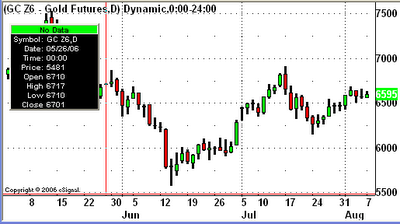

Gold traders sit on sidelines...

Monday 8/7/06 Gold trading session showed a slight bullish rally early with the help of a very bullish Crude Oil market. With the aid of a production shut down in an Alaskan Oil field that accounts for 8 percent of U. S. Production. The crude Oil was 200 + points higher towards the end of the Gold session. The Gold and the Crude for the most part are "anti " Dollar.

After the United Nations cease fire resolution was rejected by both sides early Monday afternoon. The threat of Hezbollah sending rockets into Tel-Aviv and Israel responding with rockets into central Beirut has put many Gold traders on the sidelines. However the Gold trading community seems to be loading up on calls 800-1000 strike range. This tells me most people still believe the Gold market is long term bullish.

The following are my guideline numbers for December Gold 8/8/06

resistance #2............667.50

resistance #1............663.50

pivot..........................659.50

support # 1...............655.50

support #2................651.50

pivot = position in the market that may determine direction.

resistance = possible opportunities to sell market.

support = possible opportunities to buy market.

0 Comments:

Post a Comment

<< Home