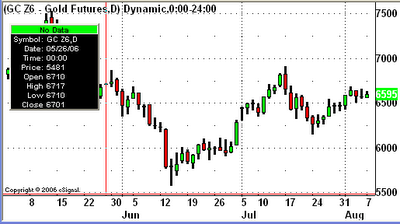

The Friday trading session in the Gold market had a trading range of $19.50 dollars.

The high of the day was 656.00 and the low was 644.00. The market was being driven by a better than expected Supply & Demand number (bullish for the Dollar /bearish for Gold) that I believe began a profit taking bear run.

News out of the Middle-east revealed the proposed cease-fire deal was not to the satisfaction of

Israeli Prime Minister Ehud Olmert. The Israeeli warplanes and artillery devastated Hezbollah

high ground rocket launching positions as well as a strategic bridge linking Lebannon with Syria.

Reorts state that the Israeli ground troops are closing in on Beirut.

This caused alot of concern for Crude Oil traders and drove the price of Crude down early causing the Gold to follow in a negative trend and forcing Gold traders to take profits.

The heavy option buying of 750-1000 strike calls continues.

The following are my guideline numbers for Monday 8/14/06....December Gold

resistance # 2..............665.00

resistance # 1..............654.50

pivot..............................645.50

support....# 1................635.00

support ...# 2................626.00

resistance = possible opportunity to sell market

support = possible opportunity to buy market

pivot = possible position in the market that may determine direction